Digital Hedge Capital aims to become an industry leader in digital asset management with world-class capabilities in identifying and designing what investors need. This is why we´ve developed multiple investment products that suite various risk profiles and financial objectives.

FIND THE RIGHT LEVEL OF RISK FOR YOU

New Investment Products

Our investment products offer access to a wide variety of crypto-trading strategies that suite diferent risk profiles and financial objectives.

CE

CERTUS CRYPTO FUND

Expected Return: 38.8%

LI

LIBRA CRYPTO FUND

Expected Return: 124.5%

Annual Volatility: 76.1%

AU

AUDENTIS CRYPTO FUND

Expected Return: 249.2%

Annual Volatility: 144.1%

INTRODUCING RISK PROFILES

Find the right level of risk for you

Just answer a few questions, and we’ll build you a personalized portfolio of strategies tailored to your preferred risk level.

QUANTITATIVE APROACH TO INVESTING

All Investment Products

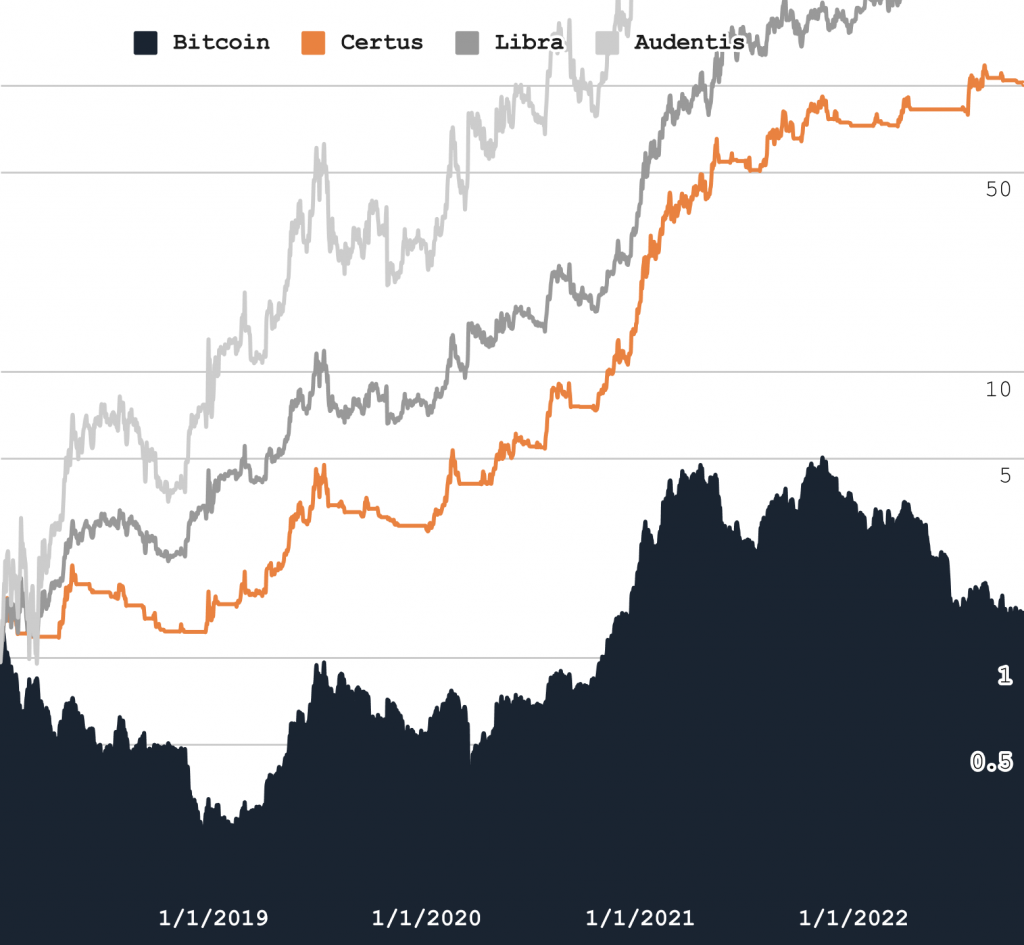

CERTUS CRYPTO FUND

The Certus Crypto Fund is the most conservative investment product within Digital Hedge Capital, with the prime objective of preserving capital and generating steadier returns.

![]()

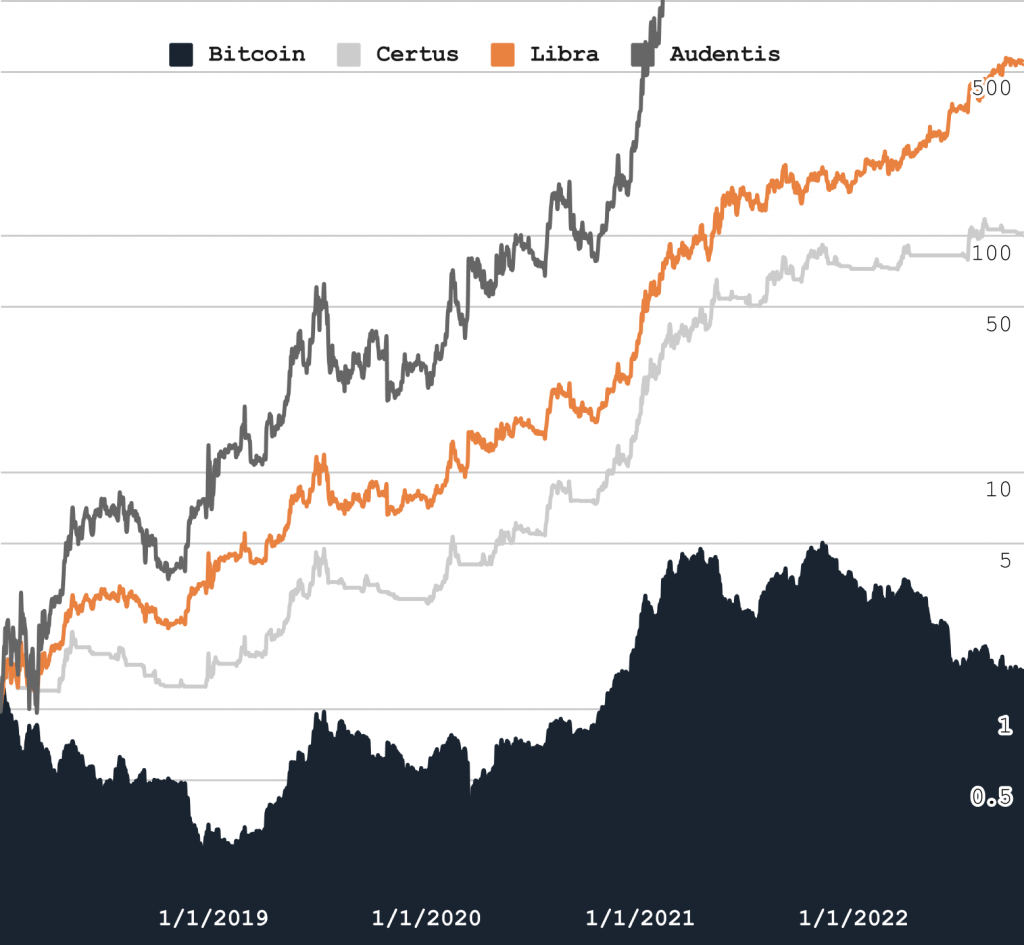

LIBRA CRYPTO FUND

The Libra Crypto Fund is the most sensitive balance between the risk reduction offered by our Certus Crypto Fund, and the amazing returns of our Altum Crypto Fund.

![]()

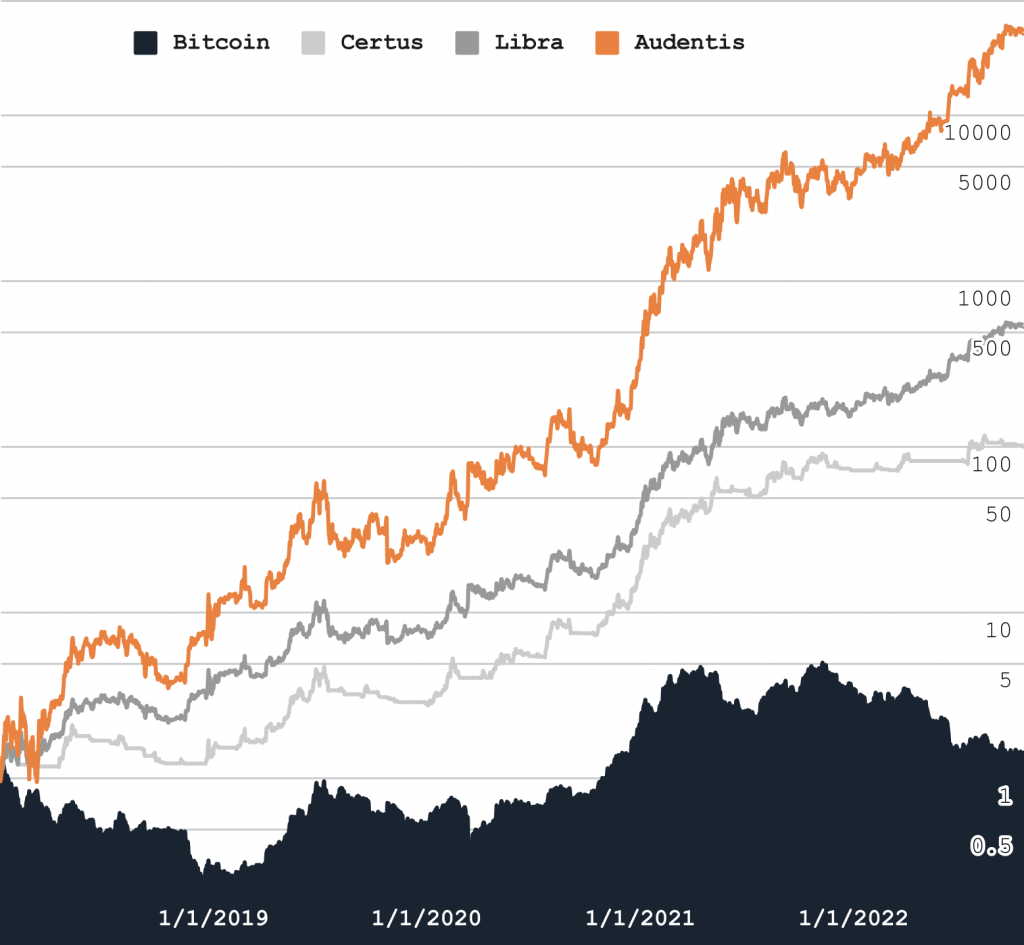

AUDENTIS CRYPTO FUND

The Audentis Crypto Fund is the most aggressive investment product within Digital Hedge Capital, with a prime focus on maximizing returns above risk reduction.

![]()

Get Invited to Exclusive Events and Relevant News.

INVESTMENT PRODUCTS

DIGITAL HEDGE CAPITAL

Algorithmic Crypto Hedge Fund & Digital Asset Management